Challenges

Quick Win

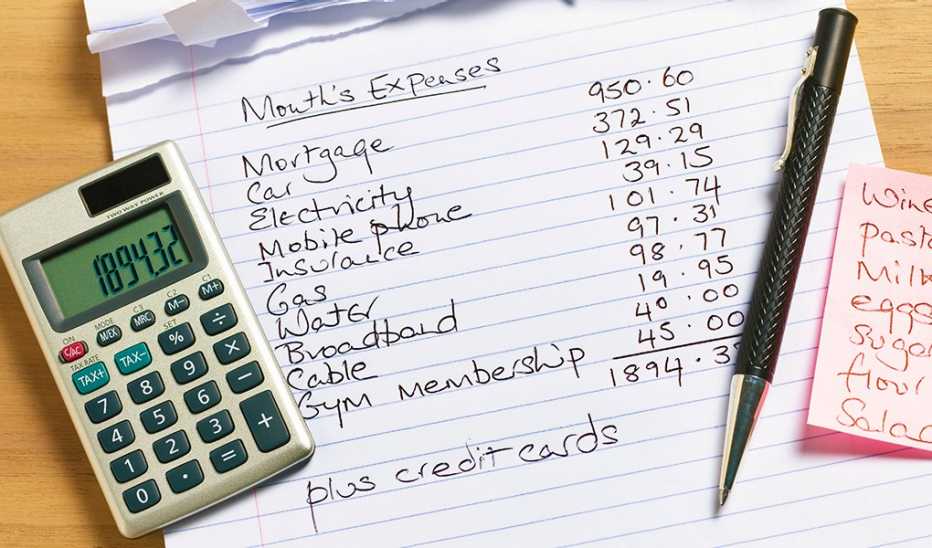

Research has shown that financial decision-making becomes more challenging as we age, but you can take simple steps to keep your money safe from scammers.

Try This Today

- Safeguard your personal info. Be wary of sharing important details like account and credit card numbers, passwords, pin numbers, your Social Security number and even your date of birth. Reputable organizations like banks and utility companies won’t ask you for this info via text or an email link. If you’re approached by someone with a paper form asking for donations, give cash instead of writing down your credit card number.

- When in doubt, hang up and call back. If you aren’t sure that the person on the phone is who they say they are, there’s a simple solution: Hang up and call the source directly using a number you can verify. Phone scams can be scary: You could be called by someone claiming to be a family member in desperate need of emergency funds, or the caller may say they’re from the IRS and that you risk going to jail for unpaid taxes. Hanging up and calling the organization’s published phone number is an easy way to determine if the scenario is real or not (usually, it’s not).

- Create strong passwords (and don’t reuse them). It’s tedious to keep up with passwords, but it’s important. If you use the same easy-to-remember password across multiple websites and apps and there’s a data breach, hackers can use that password to attempt to log in everywhere and steal as much sensitive info as possible. One fix is to use a password manager service that automatically generates complex passwords and stores them for you securely.

Why

If you find it increasingly difficult to manage and protect your finances, you’re not alone. Impaired financial decision-making can be an early sign of cognitive decline. This may help explain why older adults are often targeted by scammers; according to FBI data, people age 60-plus report more than 101,000 cases of internet-based fraud each year, adding up to $3.4 billion in losses. Those numbers are sobering, but remember, knowledge is power. Criminals tend to use the same general tactics and patterns when trying to defraud you. By staying up-to-date on the latest scams — and maintaining a healthy dose of skepticism when you get a random call, text, email or knock at the door — you can help keep your money safe and secure.

More From Staying Sharp

Spot the Misdirection in Mystery Books

Improve your critical thinking by looking for the red herrings in mystery stories

An Open Mind: The Key to Flexible Thinking

Improve cognitive flexibility by considering different viewpoints

Write a Better To-Do List

This simple tool can help you feel calm and productive